Tag: Buying Real Estate

01.25.2021

Weaker condo market is starting to attract investors

Market UpdatesWeaker condo market is starting to attract investors. We are seeing an increase in activity in the somewhat pandemic battered condo market. Investors are starting to look for deals as cash strapped condo investors/owners are struggling to rent their condos. Many investors have opted to sell. Now we see a definite oversupply of condos on the market. TRREB reported “The number of new condominium apartment listings in Q3 2020 amounted to 17,613 – an 84.6 per cent increase over Q3 2019”. Ultimately, we think this should correct as the pandemic passes and we see more immigration start to come in. However, it may take time and not everyone has time.

01.11.2021

Some housing predictions for 2021

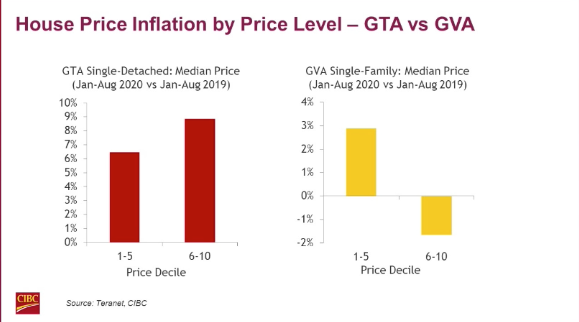

Market UpdatesSome housing predictions for 2021. CIBC issued their weekly market update with some very interesting observations and predictions. The pandemic has resulted in job loss in the lower end of the job sector including services which is a major factor. The higher end job sector has for the most part not been impacted, people spent less hence they saved money plus interest rates are very low. They need and want more space and have created demand in the higher end market. On the other hand, the demand for less expensive houses is less due to economy. Hence in Toronto, the more expensive houses have escalated faster than the less expensive ones. So if you are a mover upper the house that you are buying is rising faster than your house. This will impact the trajectory for the market this year. Vancouver on the other hand which is heavily influenced by foreign investment in the more expensive houses has the reverse effect. This is shown in the graphs below.

In general the prediction is that real estate will be strong this year, particularly spring and moving forward. We are bracing for a busy year.

CIBC WEEKLY MARKET UPDATE & 2021 FORECAST – LIGHT AT THE END OF THE COVID TUNNEL Benjamin Tal Deputy Chief Economist, CIBC Capital Markets